Amortization schedules are crucial tools for anyone navigating the world of loans, whether for a home, a car, or other significant purchases. By understanding these schedules, you can manage your finances more effectively, save money, and have a clearer picture of your repayment progress. In this article, we will explore what amortization schedules are, how they function, and why they are important.

What is an Amortization Schedule?

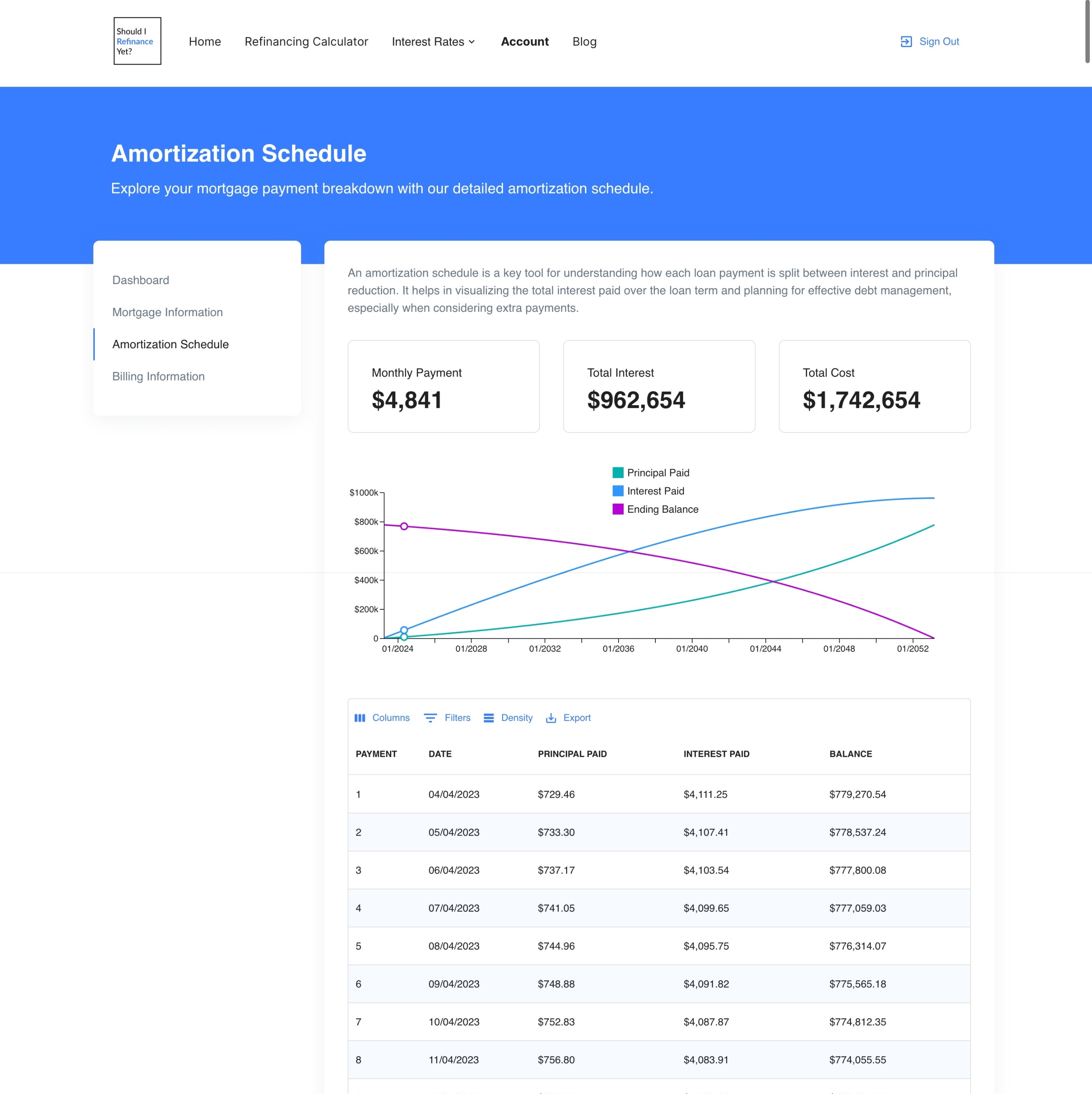

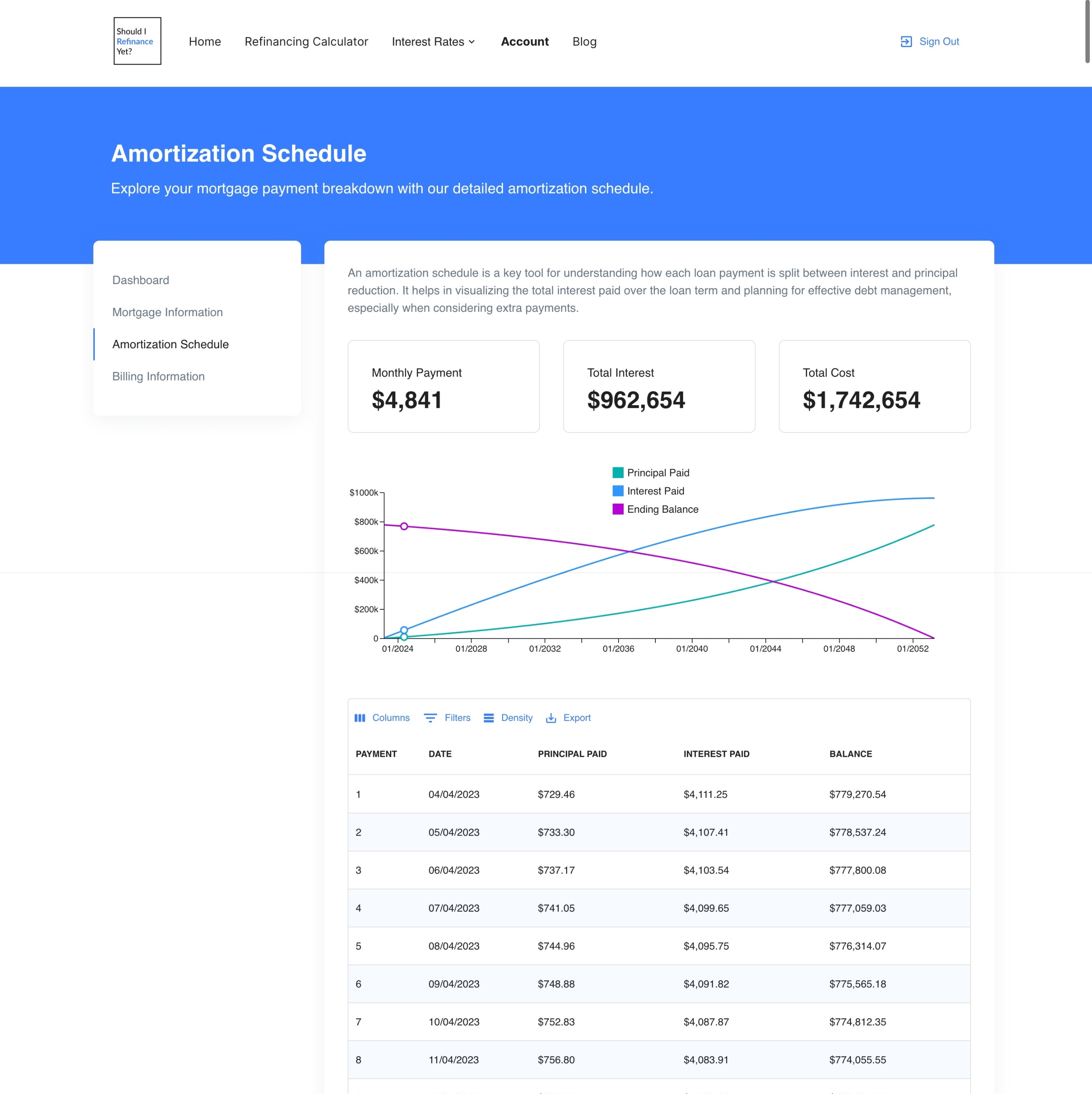

An amortization schedule is a detailed table that outlines each periodic payment on a loan over a set period. This schedule breaks down each payment into two components: principal and interest. The principal is the amount that goes toward reducing the loan balance, while the interest is the cost of borrowing the money. By detailing these components, the schedule provides a transparent view of how each payment affects your loan balance over time.

How Amortization Schedules Work

Amortization schedules typically include the following columns:

Payment Number: Indicates the sequence of payments from the first to the last.

Payment Date: The date on which each payment is due.

Payment Amount: The total amount paid in each period.

Interest Amount: The portion of each payment that goes toward interest.

Principal Amount: The portion of each payment that goes toward reducing the principal balance.

Remaining Balance: The outstanding loan balance after each payment.

For instance, in the early stages of a loan, a larger portion of each payment goes toward interest, while the principal portion is smaller. As time progresses, the interest portion decreases, and the principal portion increases. This shift occurs because interest is calculated on the remaining loan balance, which reduces with each payment.

Why Amortization Schedules Matter

Understanding your amortization schedule can have several benefits:

Financial Planning: Knowing how much of your payments go toward interest and principal helps you budget more effectively and plan your finances.

Interest Savings: By examining your schedule, you can identify opportunities to make additional principal payments, which can reduce the overall interest you pay over the life of the loan.

Clear Repayment Path: An amortization schedule provides a clear picture of your repayment journey, helping you stay on track and motivated to pay off your loan.

Loan Comparisons: When comparing loan options, amortization schedules can help you understand the long-term costs of different loans, enabling you to make more informed decisions.

Example of an Amortization Schedule

To illustrate, let’s consider a $200,000 mortgage with a 4% annual interest rate and a 30-year term. The monthly payment would be approximately $954.83. Here’s what the first few rows of the amortization schedule might look like:

| Payment Number | Payment Date | Payment Amount | Interest Amount | Principal Amount | Remaining Balance |

|---|

| 1 | Jan 2024 | $954.83 | $666.67 | $288.16 | $199,711.84 |

| 2 | Feb 2024 | $954.83 | $665.71 | $289.12 | $199,422.72 |

| 3 | Mar 2024 | $954.83 | $664.74 | $290.09 | $199,132.63 |

As seen in this example, the interest portion decreases slightly each month, while the principal portion increases, illustrating the gradual shift over time.

Tips for Managing Your Amortization Schedule

Regular Review: Periodically review your amortization schedule to stay aware of your loan progress and any changes in your financial situation.

Extra Payments: Consider making extra payments toward the principal. Even small additional payments can significantly reduce the total interest paid and shorten the loan term.

Loan Refinancing: If interest rates drop, refinancing your loan could provide a new amortization schedule with lower payments or a shorter term.

For those looking to take control of their loan repayment journey, Should I Refinance Yet offers a comprehensive amortization schedule feature. This tool helps you visualize your loan repayments, track your progress, and identify opportunities to save on interest.